BUDGET 2018 : SHAPING YOUR FUTURE

A Budget 2018 and Business Outlook Seminar With A Difference

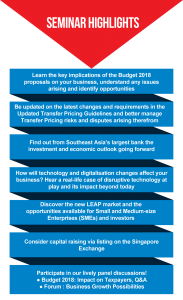

● New key tax developments and issues arising

● Investment and economic outlook

● Digital economy opportunities, China and you

We aim to offer you insights and in-depth analysis for a fresh perspective on the just tabled Malaysian Budget 2018 by the Prime Minister Datuk Seri Najib Tun Razak. And more excitingly, an outlook of business growth opportunities.

DBS Bank is recognised as the as the World’s Best Digital Bank by Euromoney, Bank of the Year, Asia by The Tanker and Best Bank in Asia-Pacific by Global Finance. It’s the largest bank in Singapore and Southeast Asia with a growing presence in Greater China, Southeast Asia and South Asia.

Today, businesses face more challenges in managing tax risk.

New reporting and transparency requirements continue to be introduced. Tax authorities increase scrutiny, enforce more aggressively and strengthen tax regulations. Employing digital technologies, corporate data is easily collected, analysed and exchanged between authorities. The news media has not been shy of reporting on cases, exposing companies to reputational risk. A key risk area is Transfer Pricing, for example.

How should you respond to meet the demands of an ever changing tax landscape? Are your current internal digital capabilities sufficient for this new world of digital tax administration?

As tax authorities enhance their digital capabilities in this global digital economy, digital technology itself changes the business landscape. Boundaries of established industry segments, business strategies and models are blurred. Your biggest competitive threat may not be from an existing competitor next door but a “sharing economy” start-up from a distant country. Disruptive technology permits financial innovation and new capital sourcing methods. It is said no sector will be immuned from Big Data and machine learning.

How will these impact you? How ready are you for all these?

Come discover and participate in the Q&A session “Budget 2018 : Impact on Taxpayers” and the forum “Business Growth Possibilities” with us on 16 November 2017.

The seminar will be an exceptional platform for professional development and networking.

It permits 8 CPD hours and is HRDF claimable under the Skim Bantuan Latihan (subject to approval of Pembangunan Sumber Manusia Bhd).

************************************************************

SEMINAR FEE*

– fee per participant –

Single Delegate, RM480

Group, RM450

(minimum 3 delegates from the same organisation.

Group offer ends 31 October 2017)

* inclusive 6% GST

**************************************************************

Participants will receive :

– 2018/2019 Business & Tax Information Booklet

– Seminar materials

– Certificate of Attendance