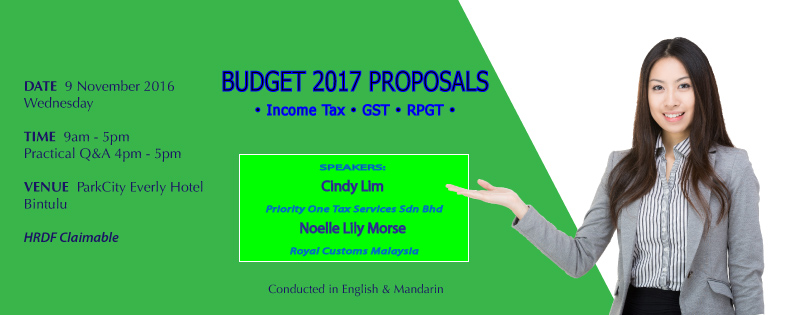

TRANSFER PRICING : Practical Aspects of Transfer Pricing Documentation

1-Day Seminar on 19 June 2018, Tuesday

8:45am – 5:15pm

Imperial Hotel, Kuching

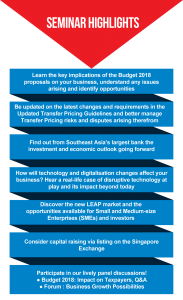

SEMINAR OBJECTIVES :

* Overview of the transfer pricing principles and the latest requirements of the Inland Revenue Board (IRB).

* Provide practical insights in preparing transfer pricing documentation.

* Provide you the knowledge and the guidance to prepare your own transfer pricing documentation supported by a detailed walk through of the various requirements with practical examples.

* Provide examples of the common mistakes which should be avoided.

BENEFICIAL FOR :

* CEOs, CFOs, COOs

* Finance Personnel

* General Managers

* Tax/TP Managers

SPEAKER’S PROFILE :

SM Thanneermalai started the first transfer pricing practice in Malaysia back in 1996. He has extensive experience in handling a vast variety of transfer pricing and corporate tax assignments. He specializes in assisting multinational companies and local conglomerates in preparing transfer pricing documentation, handling transfer pricing disputes and set transfer prices.

Mr Thannee is the founder of Thannees Tax Consulting Sdn Bhd. He was a Past President of the Chartered Tax Institute of Malaysia, Senior Tax Partner in PwC, Managing Director of Crowe Horwath KL Tax Sdn Bhd and is the Chairman of the Board of Trustees of the Malaysian Tax Research Foundation.

PROGRAMME EXCERPT :

* IRB’s main focus in the Tax/Transfer Pricing scene in Malaysia

* Issues faced by tax payers

* Explaining the latest changes to the Malaysian Transfer Pricing Guidelines eg Arm’s Length Principle

* The building blocks of Transfer Pricing documentation

* Special issues in Transfer Pricing

Please refer to seminar flyer for Programme details.

SEMINAR FEE :

RM 450 per participant (GST 0% inclusive)

8 CPD Hours, HRDF Claimable